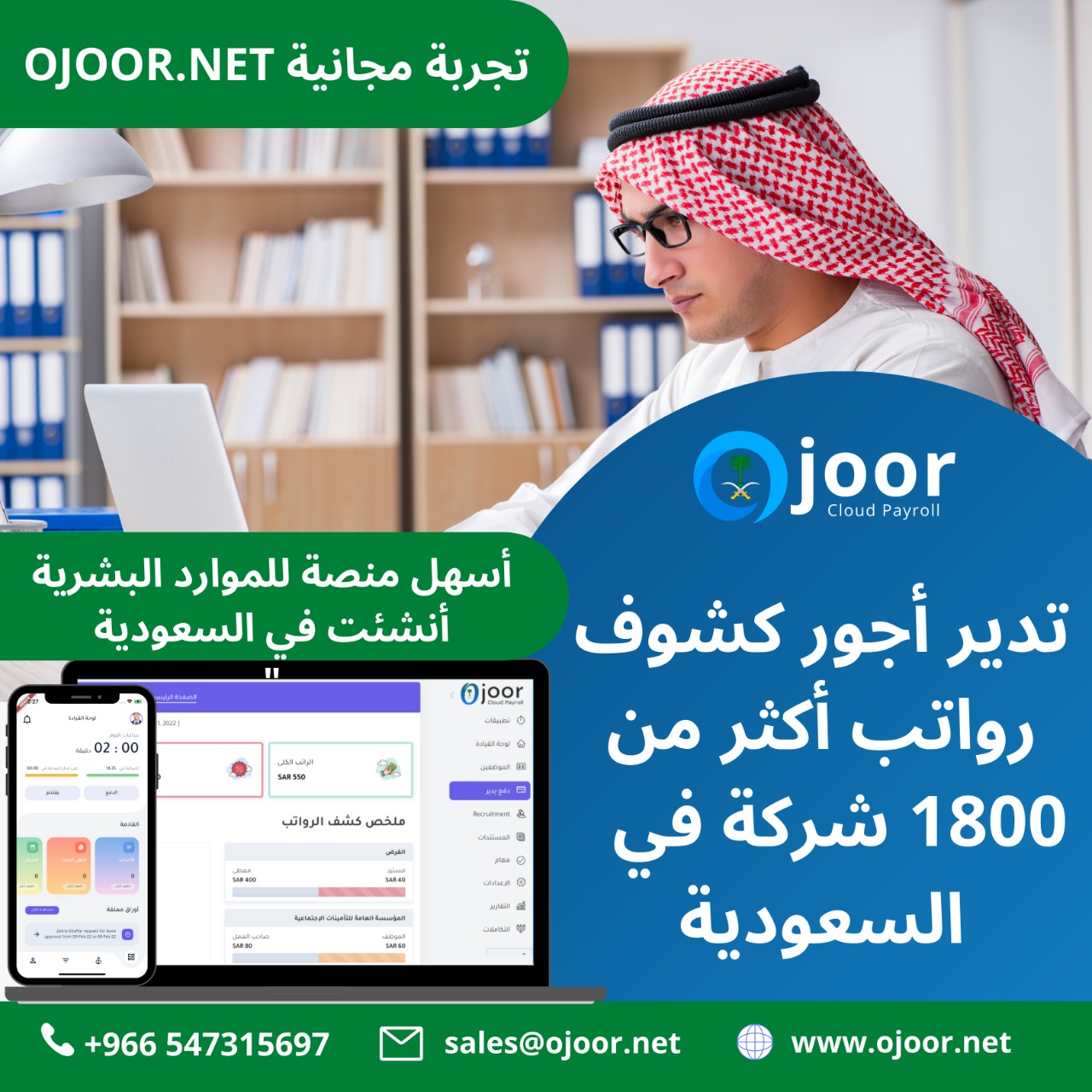

Ojoor # 1 is one of the top Payroll Software in Saudi Arabia As businesses strive for streamlined and efficient payroll management, selecting the right payroll software becomes crucial. With a myriad of options available, it’s essential to understand the key features that contribute to an effective payroll solution.

Click to Start Whatsapp Chatbot with Sales

Mobile: +966547315697

Email: sales@bilytica.com

Ojoor #1 Payroll Software in Saudi Arabia

In this blog, we will explore the essential features to look for when choosing payroll software. From employee data management to tax calculations and reporting capabilities, understanding these features will help businesses make informed decisions and find a software solution that meets their specific needs.

Employee Data Management

An excellent Payroll Software in Saudi Arabia should offer robust employee data management capabilities. It should allow businesses to securely store and manage essential employee information, including personal details, bank accounts, tax information, employment contracts, and benefits. The software should provide a centralized platform to access and update employee data, ensuring accuracy and compliance. Look for features such as customizable employee profiles, data encryption, and user access controls to protect sensitive information.

Time and Attendance Tracking

Efficient payroll software should integrate with time and attendance systems or offer built-in time tracking functionality. This feature allows businesses to accurately record employee work hours, breaks, leaves, and overtime. The software should automatically calculate hours worked and apply the appropriate pay rates, ensuring accurate payroll calculations. Look for features like real-time attendance tracking, leave management, and seamless integration with payroll processing to streamline the entire process.

Tax Calculations and Filings

Payroll Software in Saudi Arabia should simplify tax calculations and filings to ensure compliance with tax laws and regulations. It should automatically calculate taxes based on the latest rates and rules, including federal, state, and local taxes. The software should generate tax forms, such as W-2s or 1099s, and facilitate electronic filing, reducing the chances of errors and penalties. Look for software that stays up to date with tax law changes, offers automatic tax updates, and provides comprehensive tax reporting capabilities.

Payroll Processing

A crucial feature of payroll software is its ability to automate payroll processing. The software should handle complex calculations effortlessly, including salaries, wages, bonuses, commissions, and deductions. It should support various payment methods, such as direct deposit or printed checks, and generate detailed pay stubs. Look for software that allows customization of payroll components, offers flexible pay period options, and provides automatic notifications for payroll deadlines.

Compliance and Reporting

Payroll Software in Saudi Arabia should assist businesses in maintaining compliance with labour laws, tax regulations, and reporting requirements. It should generate comprehensive reports on payroll expenses, tax withholdings, and other key payroll metrics. The software should also support customization of reports to meet specific business needs. Look for features like labour law compliance alerts, tax form generation, and intuitive reporting dashboards to streamline compliance and facilitate data-driven decision-making.

Self-Service Portals

An increasingly valuable feature in the Payroll system in Saudi Arabia is self-service portals for employees. These portals empower employees to access their payroll-related information, such as pay stubs, tax forms, and benefits details. Self-service functionality reduces administrative burdens and empowers employees to take control of their payroll information. Look for software that offers intuitive and user-friendly employee portals, allowing employees to view and update their personal information, access historical pay stubs, and request time-off.

Integration and Scalability

Payroll software should integrate seamlessly with other systems, such as HR Software in Saudi Arabia, accounting, or time and attendance software. Integration ensures smooth data flow, eliminates duplicate data entry, and enhances overall operational efficiency. Additionally, consider the scalability of the software. As businesses grow and change, the software should accommodate increasing employee numbers, changing pay structures, and evolving business requirements. Look for software that supports integrations via APIs or offers built-in integrations with popular business applications.

Conclusion

Selecting the right payroll software is a crucial decision for businesses. By understanding the key features to look for, such as employee data management, time and attendance tracking, tax calculations and filings, payroll processing, compliance and reporting, self-service portals, integration, and scalability, businesses can make informed choices. Investing in robust payroll software streamlines operations, ensures accuracy, and enhances compliance, ultimately leading to efficient payroll management and overall business success.

Click to Start Whatsapp Chatbot with Sales

Mobile: +966547315697

Email: sales@bilytica.com

Payroll Software in Saudi Arabia

Payroll Software in Saudi Arabia

Payroll Software in Saudi Arabia

Payroll Software in Saudi Arabia

What are key features of Payroll Software in Saudi Arabia? similar software solutions prices were updated on 2025-07-02T01:29:57+00:00 in Saudi Arabia in Mecca, Medina, Riyadh, Khamis Mushait, Yanbu, Jeddah, Dammam, Unaizah, Uqair, Ha’il, Ta if, Al Bahah, Dhahran, King Abdullah Economic City, Najran, Diriyah, Qatif, Khafji, Jubail, Abqaiq, List of Cities and Towns in Saudi Arabia, Ras Tanura, Turubah, Jazan Economic City, Knowledge Economic City, Medina, Khobar, Abha, Tabuk, Saudi Arabia, similar software solutions prices were updated on 2025-07-02T01:29:57+00:00 We also provide in Saudi Arabia services solutions company in Hafar Al-Batin, Udhailiyah, Al-Awamiyah, Hofuf, Hautat Sudair, Buraidah, Tayma, Duba, ‘uyayna, Saihat, Al-Kharj, Al-ula, Jizan, Rumailah, Ar Rass, Arar, Shaybah, Al Majma’ah, Rabigh, Dhurma, Haradh, List of Saudi Cities by Gdp Per Capita, Badr, Sudair Industrial City, Baljurashi, Shaqraa, Al-Khutt, Habala, Ad Dawadimi, Dawadmi, Layla, similar software solutions prices were updated on 2025-07-02T01:29:57+00:00 Price is SAR 100 and this was updated on updated on 2025-07-02T01:29:57+00:00 similar What are key features of Payroll Software in Saudi Arabia? software solutions prices were updated on 2025-07-02T01:29:57+00:00 in Saudi Arabia in Haql, Afif, Al-Abwa, Farasan, Al-Jaroudiya, Thadig, Al-Thuqbah, Al Wajh, Almardmah, Al-Zilfi, Muzahmiyya, Prince Abdul Aziz Bin Mousaed Economic City, Tharmada’a, Skaka, Um Al-Sahek, Sharurah, Tanomah, Bisha, Dahaban, Al Qunfudhah, Qurayyat, Saudi Arabia, Ha’ir, as Sulayyil, Al Lith, Turaif, Al-Gway’iyyah, Samtah, Wadi Ad-Dawasir, Az Zaimah, Safwa City, Jalajil, Harmah, Mastoorah, Hotat Bani Tamim, Jabal Umm Al Ru’us, Rafha, Qaisumah, Al-Ghat, Hajrah, Al-Hareeq. Excerpt: Jeddah (also spelled Jiddah, Jidda, or Jedda; Arabic: Jidda) is a Saudi Arabian city located on the coast of the Red Sea and is the major urban center of western Saudi Arabia similar software solutions prices were updated on 2025-07-02T01:29:57+00:00 Price is SAR 100 and this was updated on updated on 2025-07-02T01:29:57+00:00

20-06-23