Click to Start Whatsapp Chat with Sales

Call #: +966547315697

Email: sales@bilytica.com

What exactly is payroll software?

To manage the payroll process is always a difficult task for any company since calculating employees’ routine salaries is a headache. Frustration with handling these tasks can be avoided by implementing automated payroll software for your business organization. As we all know, the system in the facilities needs infrastructure and a large investment, but the solution is the “Cloud-based payroll software”. It does not require any infrastructure or a large investment. Cloud-based payroll software is online software that can be accessed from anywhere, at any time.

Significantly streamlines the process, reduces errors and allows the HR department to pay more easily and quickly compared to paper payroll or the system in the facilities.

Chatbot & AI enabled Payroll Software , is the automatic process of payment of salaries to contingent salaried people (self-employed), per hour and monthly. It is a type of software that helps the HR department to compensate employees for the work done. It also helps you calculate the salaries based on the hours recorded in time and in the online assistance system, and after that, extracts the salaries or funds from the direct deposit to the employee’s account. Along with the necessary deductions and taxes are also calculated.

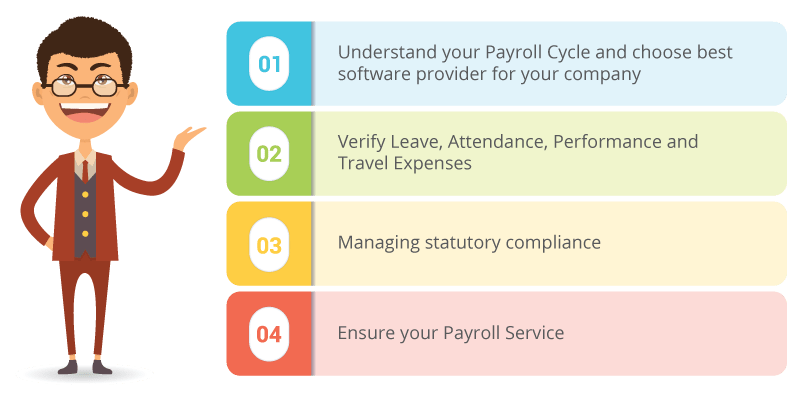

How to choose the payroll software? Let’s learn with 4 easy steps!

Understand your payroll cycle and choose the best software provider for your company:

Understand your payroll cycle and choose the best software provider for your company:

To decide the payroll cycle/payment schedule is the main responsibilities of the HR department. Therefore, taking into account your different requirements/choices, this software offers you three essential payment schedules that are the following:

- Monthly: if you have employees who are paid monthly, you can select that payment schedule. Here you have to pay your employees 12 times a year.

- Weekly: if you have employees who receive a payment each week, you can select this payment program. Here you have to pay 52 times a year to your employees.

- Daily: if you have employees who are paid daily, you can select this payment program. Here you must pay 365/366 times a year to your employees.

Choose the right payroll software according to the expense program will assist you to pay your employees in a suitable way.

-

Verify the leaves, attendance, performance and travel expenses:

It is always important to verify if your payroll software is integrated with the basic details of the employees, Absence Management, Assistance Management, Performance Management and Travel Expense Management. Chatbot & AI enabled HR Software to efficiently execute the duties and responsibilities of the organization. At the time of registration, you should only add all the details of the employees in the system. After that, when you have to process the payroll, all information, such as employee performance, travel expenses, assistance, and vacations, will be obtained automatically and you must verify the details to process the payroll.

Manage legal compliance:

Legal compliance is the legal framework, where most of the time and money of the organization is spent on guaranteeing the laws. It is necessary to administer all the legal compliance of the employees such as the minimum wage, the income tax, the pension fund, the bonus and the professional tax of the employees at the time of the payroll process.

- Minimum wages: when setting the minimum salary and linking it to your payroll, the problem of the fine at the time of the legal audit is reduced.

- Income tax: at the time of payroll, the calculation of the income tax and the automatic deduction made easy through the payroll software.

- Gratuity: the tip is the retirement benefit provided by the government after completing five years in the same company.

- Professional tax: at the time of the payroll process, the calculation according to the payroll and the status of each employee reduces the fine of corporation tax.

- If you are doing all the calculations through paper or a payroll software that is not fully automated, it will be too tedious to work with many errors. This software provides you with the integrated payroll system that automatically calculates all legal compliance along with the payroll process.

Secure your payroll service:

When you use any software, you will get some updates at some interval, which shows that you are updating your application according to the requirements and the ease of your clients/clients. If you are using the payroll software on the premises, you will not be provided with updates on the laws or self-service of the employee. While you are Chatbot & AI enabled Leave Management Software , you will get self-service for employees that will guarantee your regular and adequate payment. This software automatically updates your laws when necessary, which helps you deduct taxes properly.

https://www.youtube.com/watch?v=RHXUYKznjHo

Here is the list of features which you can get by using PeopleQlik:

- PeopleQlik Core

- Core HR Software – HRMS

- Cloud Payroll Management Software

- Employee Self Services

- HR Analytics Software

- Corporate Wellness Platform

- Workforce Administration

- Leave Management Software

- Time and Attendance Management Software

- Shift & Scheduling

- Claims & Reimbursements

- Timesheet Management Software